- Get a quote

- Jobs

-

Employers

- Employers

-

Hire Staff

-

Our Sectors

-

Testimonials

-

About

- About

-

Our Team

-

Our Company

- Contact

- Blog

- EN | PL

How To Save Your Business During The Cost-of-living Crisis

Posted by

HR GO Recruitment

on

There’s been a lot of talk in the media about how the cost-of-living crisis will affect UK households. But much less has been said about the cost to businesses. (A few days after this blog was published, the government announced their new Energy Bill Relief Scheme.)

The truth is, it’s likely to negatively affect SMEs in multiple ways. And it turns out, somewhat counterintuitively, that supporting your workforce during the crisis could actually be the key to saving your business. This is according to the latest Labour Market Insights research from Kent University.

First, let’s take a look at the current UK labour market conditions.

Is the tight labour market easing up?

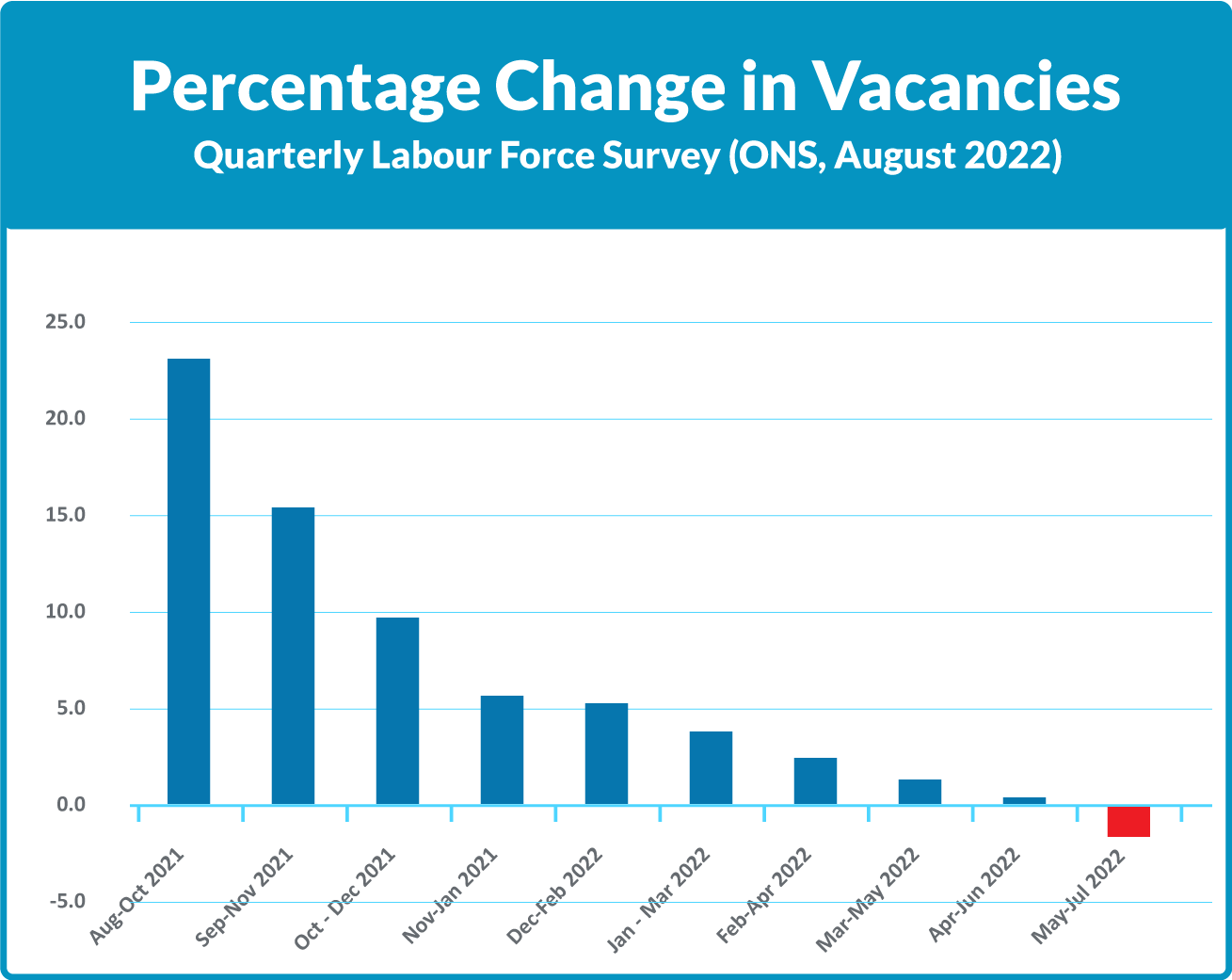

What we can say is that we are seeing signs of negative growth in vacancies since Jun-Aug 2020. In the image below, you can see this marked difference.

But prior to Covid, these decreases weren’t uncommon and with vacancies running so high, there was an expectation they would begin to fall soon. The fall is likely due to multiple factors. In fact, the current reduction appears to be driven by fewer job opportunities in smaller businesses. This is demonstrated by the fact that larger firms of 250+ accounted for around 57% of vacancies by May-July 2022. That’s a 5.6% increase from 12 months ago.

Other factors impacting the decrease in job vacancies include the Russia-Ukraine war and the increasing costs of energy which in turn drives rising inflation. As we’ve all heard by now, the UK reached a 40-year high inflation rate of 10.1% in August, and according to some reports, it could top 18% in 2023.

How higher energy costs drive inflation

Virtually everything we consume or buy is energy dependent. That means firms producing goods and services requiring energy usually have two choices when energy prices soar: either to temporarily absorb those increases (including the costs of transportation for distribution) or pass them on to their consumers. In our current situation however, oil prices have soared to a degree that makes the first option untenable for many firms, especially small businesses.

In turn, this effects the Consumer Price Index (CPI). The CPI measures the rise of prices for a typical basket of goods purchased by the average household over time. It’s not a perfect system, but it does give us a formula to measure how inflation may be experienced by the average household. And this is how we derive our inflation rate.

Cost-of-living effect on business

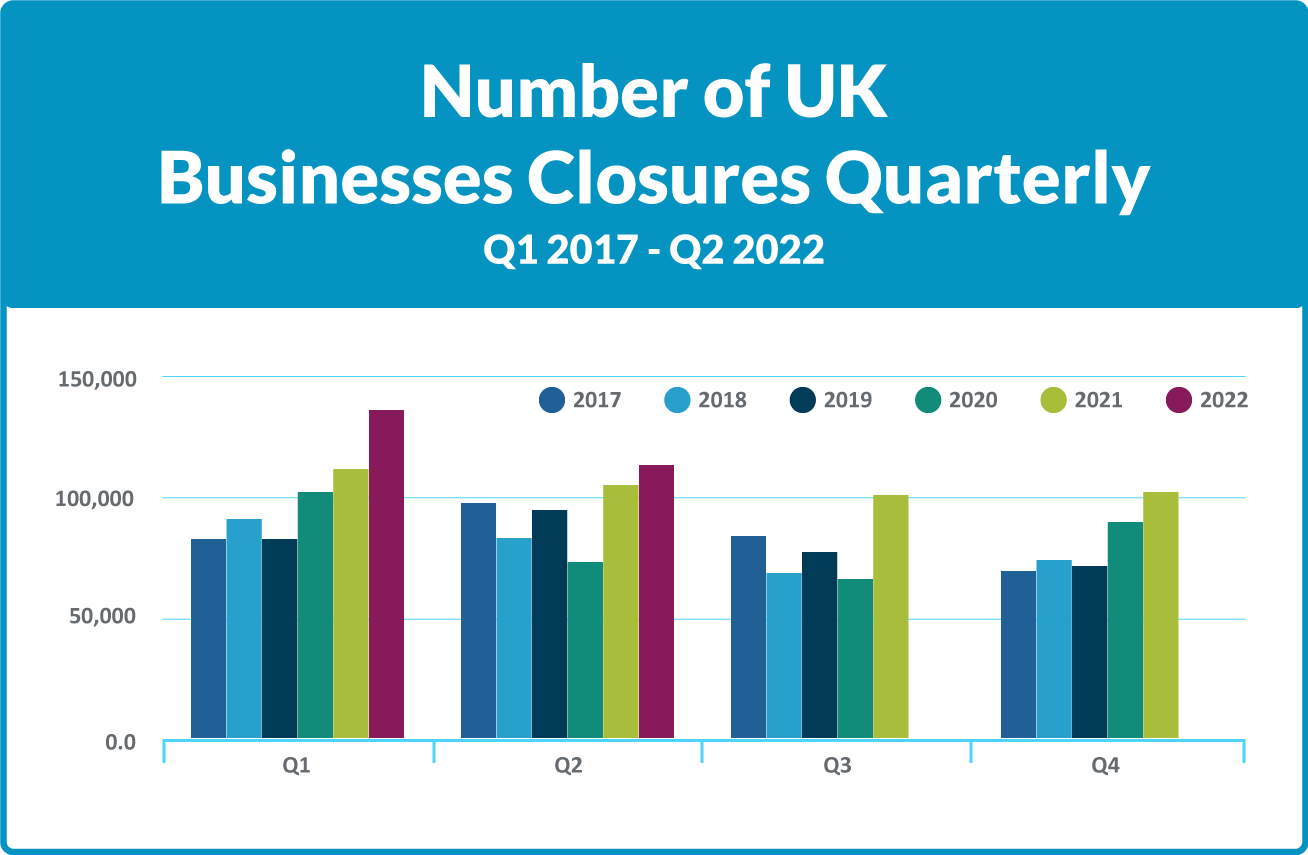

Overall, there is an expectation that there will be an increase of business failures due to the cost-of-living crisis, especially among SMEs, over the next year. This is to be expected as businesses’ profit margins decrease as a result of resisting passing on their full increased costs to consumers. Profit margins are further reduced as businesses raise workers’ wages in response to the crisis. The ONS (Office for National Statistics) keeps track of the number of businesses removed from the DBR (Inter-Departmental Business Register) on a quarterly basis which you can see in the graph below.

Although in aggregate, business closures increased between 2021 and 2022, recent empirical evidence showed that small business failures actually decreased from 15% to 5.7%. However, this good news is not expected to continue in light of higher costs and falling sales following on so closely from the challenges of Covid and Brexit.

Cost-of-living crisis effect on sectors and regions

The sector showing the largest number of closures in the UK labour market is agriculture, forestry and fishing. Its business failure rate has more than doubled since Q3 2019. Arts, entertainment and recreation is the sector with the next highest failure rate at 60% over Q3 2019. And although the accommodation and food services sector has seen the smallest increase, this is also expected to change due to high energy costs and staff shortages.

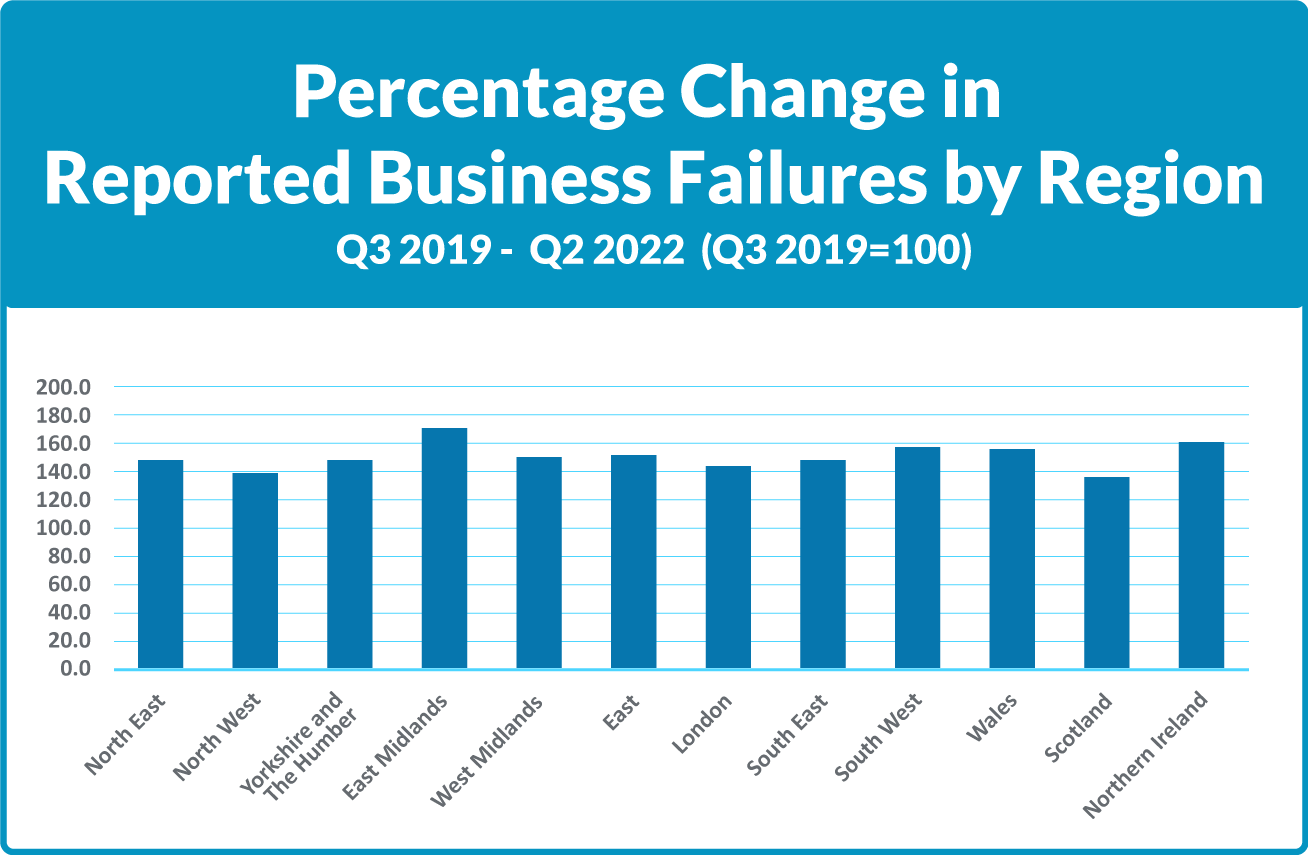

The regions that have seen the largest increase in business failures are the East Midlands and Northern Ireland. By contrast, Scotland and the the North-West had the smallest increases since Q3, 2019. The graph below shows the data compiled by the ONS.

Cost-of-living impact on your workforce

There’s no doubt the cost-of-living crisis has compelled older workers to return to the workforce to offset their financial hardships, but the labour market remains tight. Vacancy levels are still high, with 1.3 million reported for May to July 2022. Employers continue to struggle to fill roles. And now employees are starting to demand pay rises in line with inflation. Others are considering finding new jobs (75% according to one study) and still others looking for second jobs.

The financial crisis is starting to bite, with lower paid employees faring especially badly. This will increase substantially over winter with heating prices at historic highs. Research shows that financial worries are adding to stress levels, affecting mental health and the ability to perform at work. There is the very real possibility of some workers having to choose between eating and heating their homes this winter.

Without supporting employees’ financial resilience, studies show the results are likely to be declines in productivity, a demotivated workforce and resignations.

What employers can do

It has never been more important to support employees’ financial resilience. Start by having open communication and working on creative solutions. In the process, you are far more likely to retain your valuable workforce. This could be key to your business surviving the crisis. In addition you can also use your cost-of-living crisis response as a recruitment tool.

An important first step is to look at ways to support staff without adding to inflationary pressures. It can be tempting to offer inflation-matching wage increases. But it’s essential to look at the impact on the economy and your organisation for the future. Are you considering sustainable solutions?

We recommend developing a financial well-being policy. Include one-off bonuses if you can (covering energy bills over the winter months for instance) to attract and retain staff without long term spending. These can offset the cost-of-living pressures felt by your employees now, while not contributing to spiralling wage increases later. An alternative might be to offer interest-free crisis loans.

Other ideas include offering flexible working to reduce commuter costs and childcare costs, introducing a profit-sharing scheme or subsidising travel costs. Pay particular attention to those working at the lowest pay levels in your business and make sure you’re paying the accredited real living wage.

When implemented well, workforce financial well-being measures can have a significantly positive outcome for businesses. For example, this small business reports a doubling in sales and eight times higher profits since introducing its comprehensive policy.

Your financial well-being policy

The moral and business case for supporting financial wellbeing has never been stronger. The evidence is clear: financial distress has a detrimental impact on employee wellbeing and engagement. This results in lower productivity and poor business outcomes.

If you don’t yet have a financial well-being policy, now is the time to develop one. This is an important tool you’ll need in place to maintain a positive working environment for your employees to keep your business going through this crisis.

If you already have financial resources for your employees but haven’t consolidated them into a comprehensive policy, or if you haven’t communicated their availability to your workforce, that’s something you should get working on now.

For those currently without a financial well-being policy, the CIPD offers guidance on their website.

More Information: Get the Complete Academic Reports FREE

Sign up to the FREE quarterly Labour Market Trends newsletter for downloadable PDFs of the complete academic reports. Get additional research, more nuanced insights and links to source data. Just click the button below, fill in the quick form and you'll receive an immediate email with links to downloadable PDFs of the academic reports from our Kent University partnership. You'll also receive subsequent Labour Market Trends newsletters straight to your inbox.

If you're struggling to fill roles, find out how we can help you find the staff you need. Need immediate assistance? Go straight to our National Sales contact page.

Categories

Featured insights

Career spotlight: What top skills are needed in logistics?

Despite the logistics sector covering a wide range of job roles, there are some common skills needed across the board. Here are the top skills our logistics clients told us they look for in their employees.

Read moreRecent insights

How to retain good employees? Fix these quit risks.

Do you know the quit risks for your employees? We identify some common factors that boost your chance of losing staff and how you can prevent this.

Read moreWould you make a great recruitment consultant?

If you don't have a clear career path in mind, or need to switch careers, becoming a recruitment consultant can be a great option.

Read more