- Get a quote

- Jobs

-

Employers

- Employers

-

Hire Staff

-

Our Sectors

-

Testimonials

-

About

- About

-

Our Team

-

Our Company

- Contact

- Blog

- EN | PL

UK job market research for better informed hiring in 2022

Posted by

HR GO Recruitment

on

With unprecedented challenges facing employers, it is now more important than ever to understand UK job market trends. Use our research to inform the decisions you're making around recruitment, retention, and broader employee resourcing strategies.

This first blog, based on research by Drs Samantha Evans and Catherine Robinson from Kent Business School, University of Kent, presents the overarching picture of the current state of play. In subsequent blogs in this series, Drs Evans and Robinson will be examining labour market news and providing insights on the data behind the headlines.

Subscribe to our free quarterly Labour Market Trends newsletter to receive each of these blogs directly to your in-box. In addition, you’ll be provided a link to a PDF of the original academic report each blog is based on including more nuanced insights, data and full references.

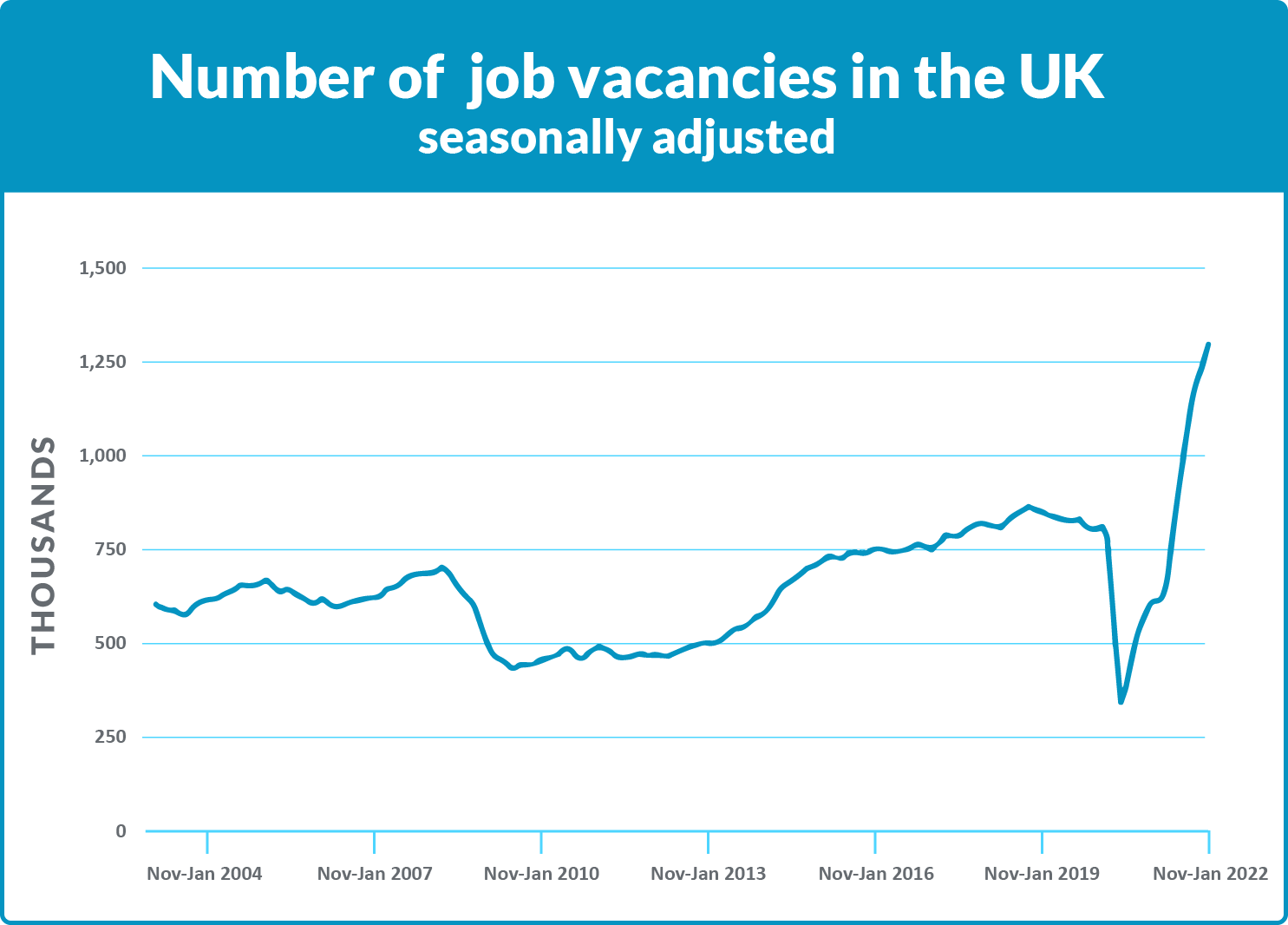

Change in job vacancies – An overview

As an employer, you’ve probably felt it: this past year has seen tremendous growth in job vacancies and recruitment difficulties. In fact, almost half of employers reported having hard-to-fill vacancies in November 2021. That’s a 21% increase from the previous quarter. This troubling situation has been analysed in academic literature. The cause is explained as a mix of pent-up demand for goods and services causing a rise in labour demand, combined with lower migrant worker numbers due to Brexit.

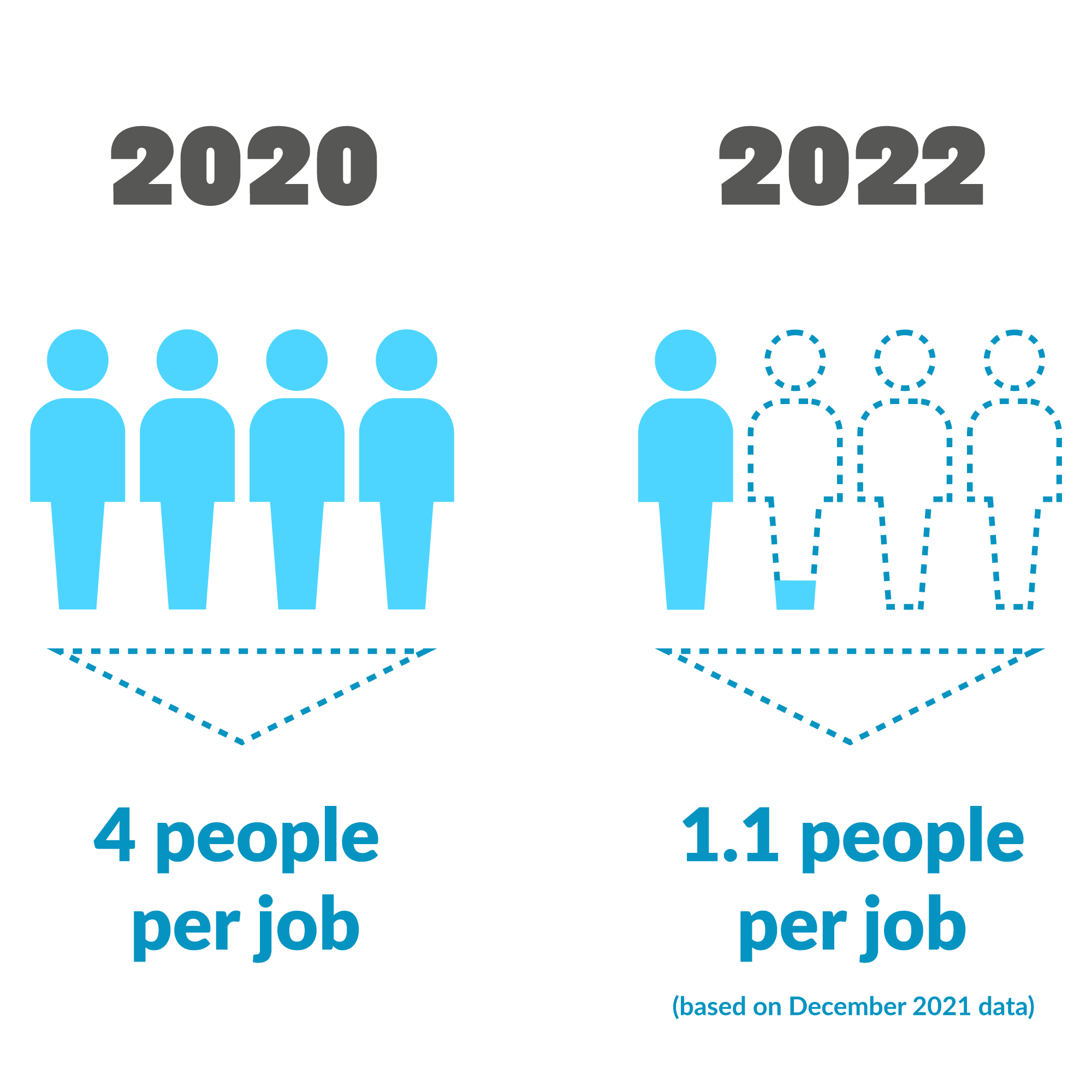

Too few workers chasing too many jobs?

We have seen an unprecedented tightening of the labour market. During the first lockdown, data compiled by the ONS reveal that there were on average 4 unemployed persons chasing one job vacancy. However, by the end of October, this had fallen to 1.2 people. In December, that number lowered further, with data showing 1.1 people per job vacancy. The result? Employers are competing harder for workers now than at any time over the last 20 years.

RECOMMENDATION: Offer increased tangible and intangible workplace benefits to attract and retain staff.

Job vacancies by business size

The growth in demand for workers shows variation across business size. Vacancies for large and very large firms (250 – 2500+ employees) have disproportionately increased. By contrast, SMEs, particularly micro businesses show a decline in the share of vacancies needing to be filled.

Online job advertisements - Timelier clues for the future?

For a more astute analysis of the market during and post pandemic, online job search data offer regional and industry breakdowns to add further insights on labour market trends. In addition, the pandemic has rapidly increased the move to primarily online job searching, making this data more representative than ever. In the graph below, you can see jobs being advertised in the UK fell during the national lockdowns and increased as restrictions decreased. This is unsurprising, but we can also take a look at regional variations.

UK job market regional variations

In general the data show that there is little variation in online job adverts by region and that pressures on recruitment are consistent across the UK. The only clear outlier is Northern Ireland. But we can also see that job adverts in London are also slightly behind the rest of the UK. This could be due to market demand for remote working combined with a reluctance to return to traditional commuting patterns.

RECOMMENDATION: London employers should offer more flexible and WFH options in addition to other incentives.

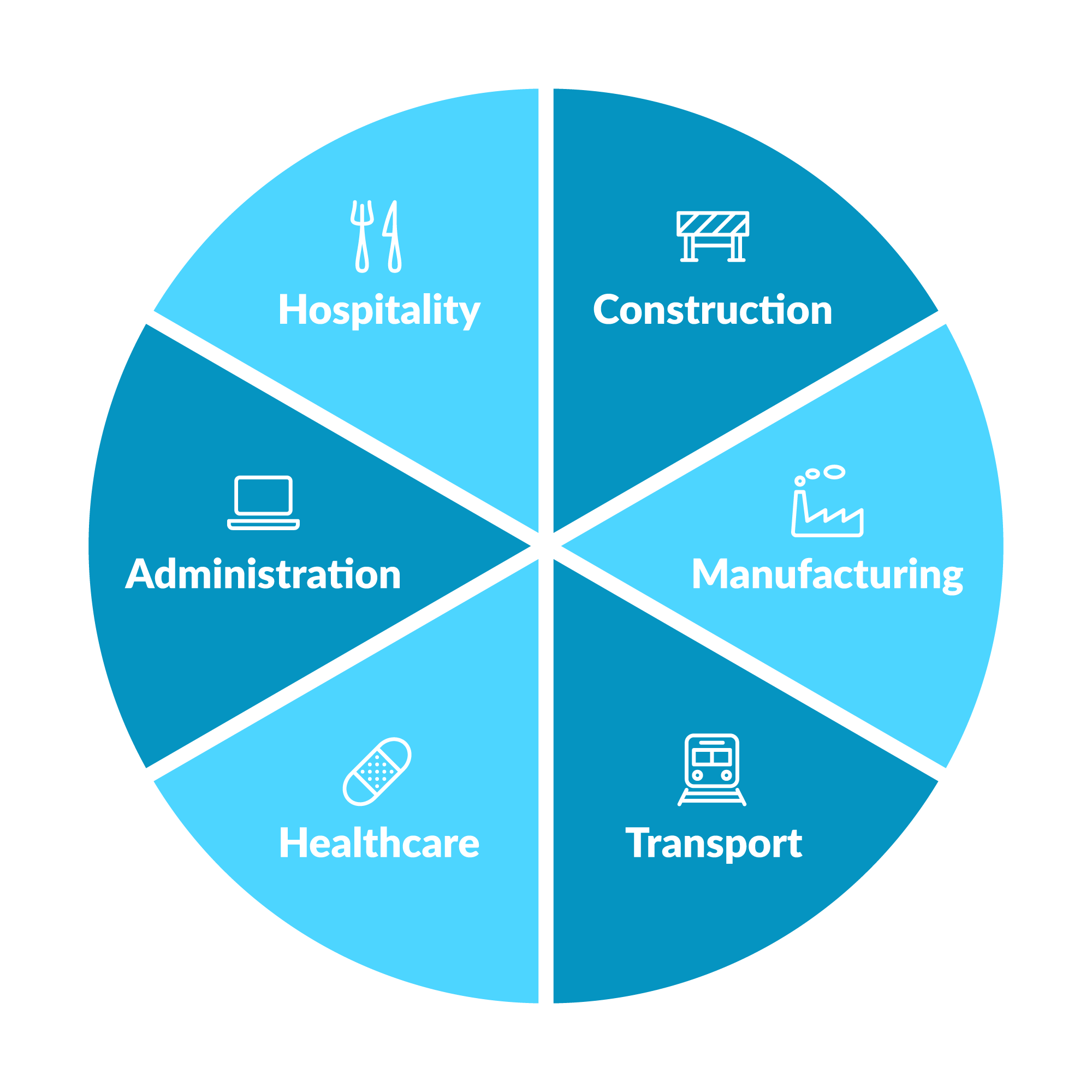

UK job market industry variations

Unsurprisingly, the airline and hospitality industries have been disproportionately affected due to travel and socialising restrictions. These sectors were effectively mothballed overnight. At the same time, the demand for growth in health and social care has increased on an unprecedented scale. So, the health and social care sectors, especially in affluent areas of the UK have rebounded more quickly.

Industry sectors with the highest vacancy growth are in transport and manufacturing. Construction, healthcare, administration/support services and hospitality have the highest demand for labour, with low-skilled vacancies being hardest to fill. That may be because these roles require a clear presence - in person at the workplace.

Although current labour market shortages appear to be highest in transportation and storage, there are also large gaps in accommodation and food services, information and communication. This presents an unusual situation in that UK workers are simultaneously in demand at the low skills and high skills end of the distribution. In addition, the transportation sector demand is exacerbated by a lag in training and the legal requirements for professional qualifications. So, this is likely to be short-lived with appropriate training capacity. However, these shortages would be increased by any subsequent lockdowns as training again becomes hard to access.

Key takeaways

- Since April 2021 the UK job market has seen tremendous growth in job vacancies.

- A rapid expansion in hiring activity has coincided with a fall in labour supply putting pressure on employers competing for scarce labour.

- Industries such as construction, transport, manufacturing, healthcare, administration and hospitality are bearing the brunt of the tight labour market.

- The data suggests a continued increase in pressures on labour supply which could constrain future employment growth.

- To offset the challenges, organisations need to think creatively to attract the best candidates.

Sign up to the quarterly Labour Market Insights newsletter for downloadable PDFs of complete academic reports with links to sources.

If you're struggling to fill roles, find out how we can help you find the staff you need. Need immediate assistance? Go straight to our National Sales contact page.

Categories

Featured insights

How to solve the challenges of working from home

Now so many of us are remote working, we've also discovered the challenges of working from home. Here are some tips for simple solutions.

Read moreRecent insights

Can your business benefit from 'The Great Resignation'?

It may surprise you to learn that your company can benefit from 'The Great Resignation.' In this blog, we show you which top 3 issues can help you beat the competition for candidate wins.

Read more4 tips for return-to-work success in 2022

If you're heading back into the workplace, read our 4 tips for successful job seeking.

Read more